YOUR CUSTOMERS HAVE CHANGED. HERE’S HOW TO ENGAGE THEM AGAIN.

The coronavirus makes your customers less able and less willing to spend than before.  How should you re-engage with them? Advice from Rohit Deshpandé and colleagues.

How should you re-engage with them? Advice from Rohit Deshpandé and colleagues.

The coronavirus shock has disrupted more than jobs, supply chains, and financial markets. Your customer has changed fundamentally, too. The number one task for many companies now is discovering where their B2C and B2B customers have moved to and re-engaging with them.

COVID-19 is a different beast than recent economic crises and recessions such as the Great Recession of 2008 and the Mideast oil crisis, whose causes were financially driven. The fundamental driver of the pandemic is health and safety concerns and hence customer driven. Customers’ immobility and desire to be safe in the current environment has resulted in volatility in purchases and productivity across idiosyncratic product categories, resulting in a net economic crisis of a type that has not been witnessed by anyone alive today.

Government-imposed quarantines, self-isolation, and closures of stores and offices have further forced changes to customers and hence firm-based behaviors. The outcome of customers’ health and fears has resulted not in a traditional recession but a “deaccession,” where supply and demand exist, but customer-access to products and services has been significantly shut off.

“RESEARCH DEMONSTRATES THAT FIRMS WHO MAINTAIN OR ACCELERATE CUSTOMER-CENTRIC PHILOSOPHIES CONSISTENTLY OUTPERFORM FIRMS THAT DO NOT.”

All in all, this set of circumstances and stricter budget constraints make customers less able and less willing to spend compared to past recessions. How will you find them? How will you engage them?

How should firms adjust? What is clear in the COVID-deaccession is that this change in customer behavior is pushing firms into a new “directional reality.” Firms need to adapt to shifting customer wants by engaging a more customer-centric philosophy. Rather than expecting their customers to come to them, they need to go to their customers.

Past research demonstrates that firms who maintain or accelerate customer-centric philosophies consistently outperform firms that do not. In fact, they gain market share from competitors who cut back on customer-centric investments.

During this COVID-deaccession, it is even more critical for firms to become more customer centric by researching and understanding their customers’ new problems caused by fear, isolation, physical distancing, and financial constraints, and attempt to structure their offerings to meet these new unmet wants and needs.

The velocity or rate of adaption that firms need to adjust to a new directional reality will depend on customer demand. Industries with decreasing customer demand—offline entertainment, hospitality, real estate, industrial commodities, and suppliers to these industries—need to adjust rapidly to give them a better chance of surviving.

In contrast, industries with increasing customer demand—grocery stores, online entertainment, teleconference providers, and their suppliers—need to adjust to this directional reality at a slower, yet definitely needed, pace to help sustain growth for the longer term.

Whether industries are experiencing decreases or increases in demand, all firms and organizations need to take a step back or forward and ask themselves: What should be my minimally viable strategy to get through these unprecedented times?

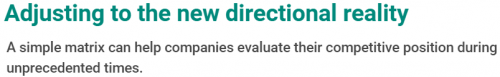

Which directional reality should your firm pursue? To adapt to a new customer-centric directional reality, we propose an alternative to Ansoff’s (1965) growth strategy matrix (see table below). The proposed 2 x 2 matrix is categorized by whether the firm is competing with existing versus new or modified products and services, and whether it is competing in current or new markets (i.e., new customers and/or new geographies).

First Quadrant: Firms stay in the status quo or pre-COVID situation. As discussed earlier, times have changed, and business cannot be run as usual. Firms must go to their customers instead of just relying on their customers coming to them. Thus, maintaining the status quo or first quadrant behavior is not advised. We need to go beyond status quo in the new abnormal.

Second Quadrant: Firms create new products or services. Firms may consider adding new services or tiers of products that meet customers’ deaccession-based basic unmet needs. Walgreens allowed customers to purchase a number of products at their drive-through because of their fundamental utilitarian-based health and safety needs. TechSee is providing European organizations free access to their artificial reality (AR) annotation products on mobile phones. AT&T, Cisco, and Zoom have enhanced their network capabilities for increased demand in bandwidth. In addition, numerous small businesses like restaurants and home goods retailers try to match increased demand by allowing customers to purchase by email, messaging services, or phone orders. While the first quadrant, or status-quo, is dead, the new normal is the second quadrant.

Third Quadrant: Firms expand into new customer markets with their existing products or services. For many companies, demand in the first quadrant has dropped sharply—they must find new markets to grow. Hence, American, Delta, and United Airlines are now employing airplanes previously targeted for passengers to fulfill cargo deliveries. For some firms, their products or services are now useful and in demand by new customer bases. Cintas is expanding its business-cleaning offerings to new markets to match new demands and unmet needs. Zoom removed time limits from basic accounts for primary school educators who now need to use its teleconferencing software for teaching. Fan Interactive Marketing, which provides customer relationship management and digital marketing tools for entertainment venues and sports teams (largely unused during the pandemic), switched to targeting small- and medium-sized traditional businesses struggling to survive.

Fourth Quadrant: Firms diversify simultaneously into both new markets and new products and services. Firms whose customer demand for their core products and services has decreased need to find new customers for new products and services in segments experiencing steep increases in demand. Thus, Dyson, GM, Ford, Volkswagen, and Tesla attempted to produce ventilators for hospitals, British Honey Company is making hand sanitizers, and Louis Vuitton, Nivea, and Zara are making surgical masks, disinfectants, and other medical-related devices.

What principles should your firm employ? So far, we have discussed and proposed high-level strategies firms should employ to navigate the COVID-deaccession crisis. We now provide five customer-centric principles for firms to deploy.

- Expand your digital footprint. Companies need to adjust to the new reality that customers prefer not to come into their stores. B2C firms must enhance their delivery and pickup options and provide incentives to customers to reward them using these options. Dunkin’ provides extra loyalty points to customers who pre-order on mobile apps. HBO made numerous shows available for free on its app to drive subscriptions for its services in the near future. Opportunities also exist for B2B technology firms. Suppliers can provide customers with enhanced ecommerce services that are in great demand. Shopify provides multiple services to small businesses to enable greater digital footprints. Hootsuite provides their professional service platform for free to small businesses for a good reason; business growth by these firms is expected to increase soon. Similarly, Alibaba, Baidu, and Tencent have made cloud services in China free to small businesses.

- Reward your loyalist. Firms can introduce special offerings to customers requiring special considerations because of their risk level, creating more loyal customers for the longer term. The Knot Worldwide is providing financial assistance to its vendors (like caterers, flower companies, and apparel brands) to help them get through hard times. Netflix set up a $100 million fund to help creatives like actors, producers, and writers whose jobs are affected by COVID—making Netflix the likely preferred destination for future work by creatives. Walmart is paying suppliers more quickly. Costco, Whole Foods, and Dollar General introduced shopping hours for senior citizens while Woolworths Supermarket in Australia closed a number of stores with less traffic to better enable deliveries to seniors, those with disabilities, and those in quarantine or self-isolation.

- Connect emotionally. To accommodate such demands, firms such as Deliveroo, Uber Eats, UPS, and FedEx, are providing touchless end-point delivery. Maersk, a leader in shipping services, kept its sailors on ships to ensure their safety and continued cross-national shipping. Alibaba and JD.com employed mandatory health checks and use of safety equipment in its factories and delivery trucks so suppliers could get their products to their end-customers. Finally, Dettol created the #HandWashChallenge to encourage proper washing techniques while using its product, garnering over 20 billion views on TikTok. Firms that connect emotionally with their external and internal customers and emotionally and physically with employees are expected to perform better than firms who just connect with their customers physically.

- Recognize financial constraints. Many customers are facing financial hardship caused by layoffs, furloughs, and a reduction in their employment hours due to the COVID-deaccession. Firms should initiate crediting and financing, deferral of payments, new payment terms, and renegotiation of rates to those in need. Such efforts will encourage longer-term relationships and loyalty, which will increase revenue and reduce transaction costs. DoorDash is temporarily waiving commission fees to restaurants for its services in multiple countries with expectations the restaurants will likely employ DoorDash in the future. M-Pesa implemented fee-waivers in Kenya and other African countries to encourage use of its financial services and reduce the need for a physical exchange of currency. IAG and many other insurance firms are offering refunds, deferred payments, and no charges to small businesses experiencing financial hardship, knowing these companies are likely to continue as long-term clients.

- Turn threats into opportunities. Instead of waiting for their customers, firms need to proactively reach out to their potential and current customers about products/services, digital and delivery options, health safeguards, and payment plans. 7-Eleven advertises on Spotify about its availability of daily staples, attracting a new segment of customers. Staples offers free delivery and special promotions to individual home-office customers. Alibaba increased training offerings to a broader set of customers in China on how to use its platforms.

Making sense of it all

As the COVID-deaccession crisis has fundamentally shifted customer behavior toward fulfilling more utilitarian-based demands for fundamental needs, firms need to adjust their directional reality to one of three proposed growth strategies. The pace firms should use to adapt to this directional reality will be based on their level of demand, with those with decreasing demand required to urgently adjust, while those with increasing demand adapting at a slower pace or with more limited offerings.

And whether demand has declined or increased during such unprecedented times, all firms and organizations need to ask: What is my minimum viable strategy going forward during this period?

About the Authors

Rohit Deshpandé is Sebastian S. Kresge Professor of Marketing at Harvard Business School. Ofer Mintz is Senior Lecturer and Associate Head of External Engagement of the Marketing Department at the University of Technology Sydney Business School. Imran S. Currim is UCI Distinguished Professor, Professor of Marketing, and Director, Beall Center for Innovation and Entrepreneurship, at the Paul Merage School of Business, University of California, Irvine.

Harvard Business School | 16 JUN 2020|by Rohit Deshpandé, Ofer Mintz, and Imran S. Currim